Polylactic Acid (PLA) Market Size to Surpass USD 3,864.79 Million by 2034 Amid Rising Demand for Sustainable Packaging

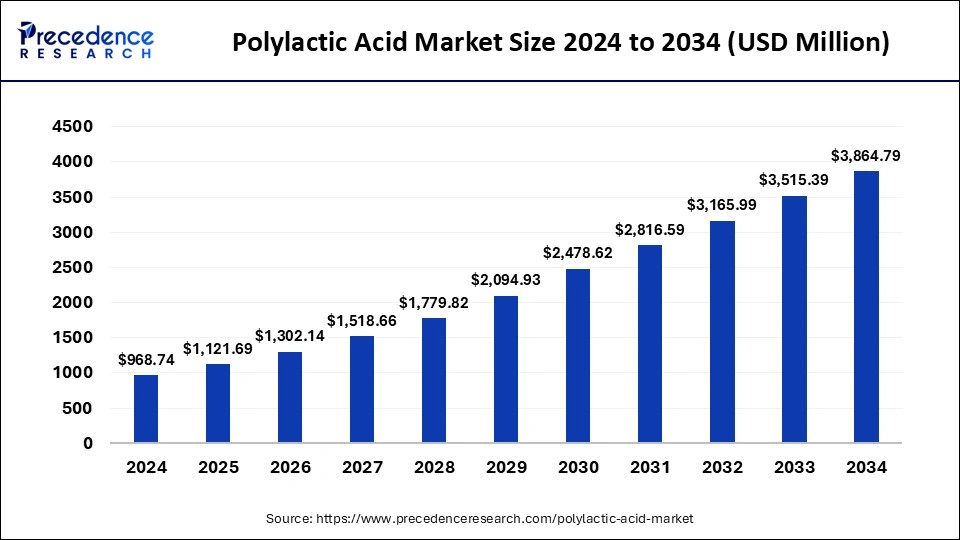

According to Precedence Research, the global polylactic acid (PLA) market size is projected to surpass USD 3,864.79 million by 2034 increasing from USD 1,121.69 million in 2025, driven by strong demand in packaging, textiles, and medical sectors, with a CAGR of 14.73%.

Ottawa, July 18, 2025 (GLOBE NEWSWIRE) -- In terms of revenue, the polylactic acid market was estimated at $968.74 million in 2024. The firm expects the value to shoot up to $3,165.99 million by 2032, with an impressive compound annual growth rate (CAGR) of 14.73 percent over the decade. While the U.S. PLA market is anticipated to exhibit a strong CAGR of 15.76% over the period. The growing demand across sectors like textiles, medical, packaging, and automotive drives the market growth.

The global demand for sustainable materials is accelerating, and polylactic acid (PLA) a biodegradable polymer derived from renewable resources, is at the forefront. With governments enforcing bans on single-use plastics and consumers seeking greener alternatives, the PLA market is set for rapid expansion. The latest report from Precedence Research unveils key trends, growth drivers, and strategic opportunities shaping the PLA landscape through 2034.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Download the Free Sample Report Now! https://www.precedenceresearch.com/sample/1244

Polylactic Acid Market Overview and Potential

What is Polylactic Acid?

Polylactic acid (PLA) is a bio-based and biodegradable plastic material. It is derived from renewable sources like sugarcane, sugar beet, corn starch, & many more and is also known as polylactide. The condensation polymerization and ring-opening polymerization techniques are widely used for the production of polylactic acid. It consists of high-strength material and is highly biodegradable.

It decomposes in the water, carbon dioxide, and lactic acid. PLA is biocompatible and has good room temperature strength. It requires low energy for production and is safe to use in food applications. PLA is widely used in medical implants, textiles, automobiles, packaging, and 3D printing filaments.

What is Polylactic Acid Market?

The Polylactic Acid (PLA) market refers to the global or regional economic ecosystem involving the production, distribution, and consumption of PLA-based materials, a biodegradable, bio-based thermoplastic derived primarily from renewable resources such as corn starch, sugarcane, or cassava.

What This Means for Investors and Industry Leaders:

With its robust CAGR of 14.73% through 2034, the PLA market offers compelling growth potential. Industry stakeholders should watch for advancements in PLA production technology, rising public-private partnerships, and localization of supply chains in Asia-Pacific. Companies investing in bioplastics now will be better positioned to meet tomorrow’s regulatory and consumer demands.

Quick Insights: Polylactic Acid Market Highlights:

- The worldwide polylactic acid market was evaluated at USD 968.74 million in 2024.

- It is anticipated to reach USD 3,864.79 million by 2034.

- The PLA market is expected to expand at a double-digit CAGR of 14.73% from 2025 to 2034.

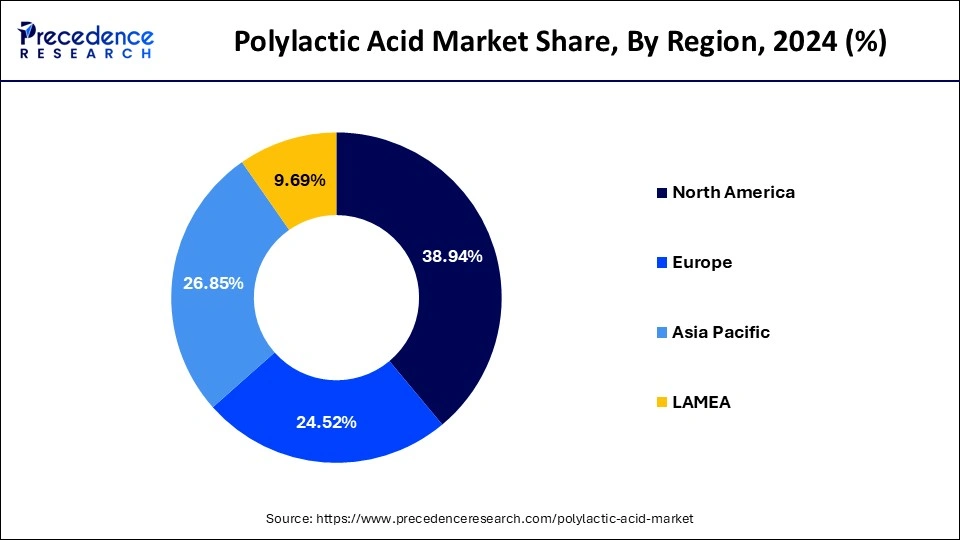

- North America accounted for the major market share of 38.94% in 2024.

- By raw material, the cornstarch segment contributed the highest market share in 2024.

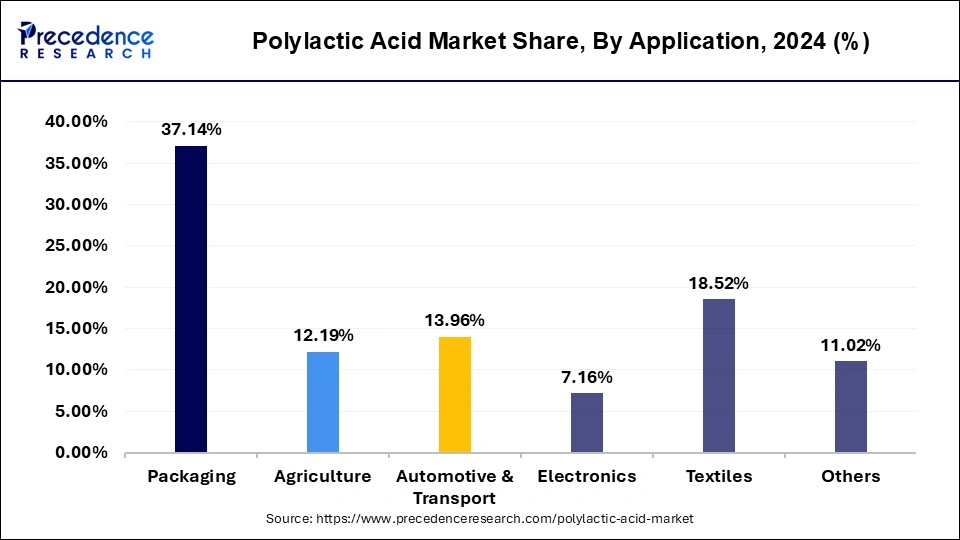

- By application, the packaging segment held the largest market share of 37.14% in 2024.

- By component, the sugarcane and sugar beet segment is expanding at a significant CAGR from 2025 to 2034.

Get the complete picture – Browse the full report today! https://www.precedenceresearch.com/polylactic-acid-market

Major Applications of Polylactic Acid?

- Food Packaging – Used for compostable containers, films, and trays due to its food safety and biodegradability.

- 3D Printing – Popular as filament material for desktop FDM printers because it's easy to print and environmentally friendly.

- Biomedical Devices – Employed in sutures, implants, and drug delivery systems thanks to its bioabsorbable properties.

- Agricultural Films – Applied in mulch films and seedling trays that degrade in soil, reducing plastic waste in farming.

- Textiles & Fibers – Used in clothing, upholstery, and hygiene products due to its breathable and biodegradable nature.

- Disposable Tableware – Common in cutlery, plates, and cups for eco-conscious food service applications.

- Cosmetic Packaging – Selected for sustainable cosmetic containers and jars with a lower environmental footprint.

- Electronics Casings – Found in cases for phones or gadgets, especially in green product lines.

- Toys and Consumer Goods – Used in biodegradable toys and homeware for safety and sustainability.

- Medical Scaffolds – Utilized in tissue engineering as a temporary framework for cell growth and healing.

What are Major Factors Responsible for Polylactic Acid Market’s Growth?

- The growing plastic pollution increases demand for PLA.

- The government regulations on plastic use increase the adoption of PLA in various industries

- The growing demand for disposable cutlery and food packaging fuels demand for PLA.

- The rising demand across the textile and automotive industries for various applications.

- The growing production of electronic components is fueling demand for PLA.

Top Exporters of Polylactic Acid in 2023

| Country Name | Export |

| United States | $166 M |

| Netherlands | $102 M |

| Thailand | $ 91.1 M |

(Source: https://oec.world)

Polylactic Acid Market Opportunity

What are the Applications of Polylactic Acid in the Medical Industry?

Growing Medical Applications: Opportunity to Unlock in Polylactic Acid Market

The growing medical applications and rising demand for various medical devices increase the demand for polylactic acid for various applications. The increasing demand for drug delivery increases the adoption of PLA to create nanoparticles and microspheres. PLA helps to control drug release and ensures biocompatibility. The increasing demand for tissue regeneration is fueling demand for PLA to form new tissues and provide structure to cells.

The creation of various implants like tissue, bone, and cartilage requires PLA to provide support. The increasing surgeries, like maxillofacial and orthopedic, increase demand for PLA. The rising production of various medical devices like pins, sutures, and screws is fueling demand for PLA due to its biodegradability and biocompatibility.

The medical applications, like filtration membranes and wound dressing, widely use PLA. The growing shift towards using sustainable materials in medical applications increases the adoption of PLA. The growing medical applications create an opportunity for the polylactic acid market.

“The accelerating demand for bio-based plastics across industries shows that sustainability is no longer optional, it is a business imperative,” said Saurabh Bidwai a Principal Consultant at Precedence Research.

Driving the Circular Economy: Sustainability at the Core:

As corporations and governments strive toward net-zero goals, PLA plays a vital role in building circular economies. From compostable food packaging to recyclable textile fibers, PLA helps reduce landfill waste and carbon emissions. Ongoing innovation is making PLA even more energy-efficient to produce, further cementing its role as a next-gen sustainable material.

Polylactic Acid Market Challenges and Limitations:

High Production Cost Limits Expansion of Polylactic Acid

Despite several benefits of polylactic acid in various industries, the high production cost restricts the market growth. Factors like a complex manufacturing process, the need for specialized equipment, and the high cost of raw materials are responsible for high production costs. The fluctuations in the prices of raw materials like cassava, corn starch, and sugarcane increase the production cost.

The complex manufacturing process, like polymerization, fermentation, and purification of lactic acid, increases the cost. The high investment in the development of PLA facilities leads to higher production costs. The volatility in oil prices increases the cost. The need for specialized processes and equipment fuels production costs. The high production cost hampers the growth of the polylactic acid market.

Additionally, the lack of adequate composting infrastructure in many regions hampers PLA’s full lifecycle potential. Variability in feedstock prices and supply (especially corn and sugarcane) poses operational risks. PLA also faces growing competition from emerging biopolymers like PHA and PBS, which may offer better performance under certain conditions.

Emerging Technologies Shaping PLA Production:

Advanced polymerization processes, microbial fermentation, and improved catalyst systems are enabling higher purity PLA at lower cost. AI is also being integrated to optimize process controls and lifecycle analysis. Innovations in blending PLA with starch or natural fibers are expanding its application range in electronics, construction, and consumer goods.

Ongoing innovation is focused on developing high-temperature-resistant PLA grades, improving mechanical properties, and exploring new feedstocks like algae. AI-enabled process optimization and enzymatic recycling of PLA waste are gaining attention, making the polymer more scalable and circular.

Polylactic Acid Market Scope

| Report Coverage | Statistics | |

| Market Size in 2024 | USD 968.74 Million | |

| Market Size in 2025 | USD 1,121.69 Million | |

| Market Size in 2030 | USD 2,478.62 Million | |

| Market Size in 2032 | USD 3,165.99 Million | |

| Market Size by 2034 | USD 3,864.79 Million | |

| CAGR 2025-2034 | 14.73% | |

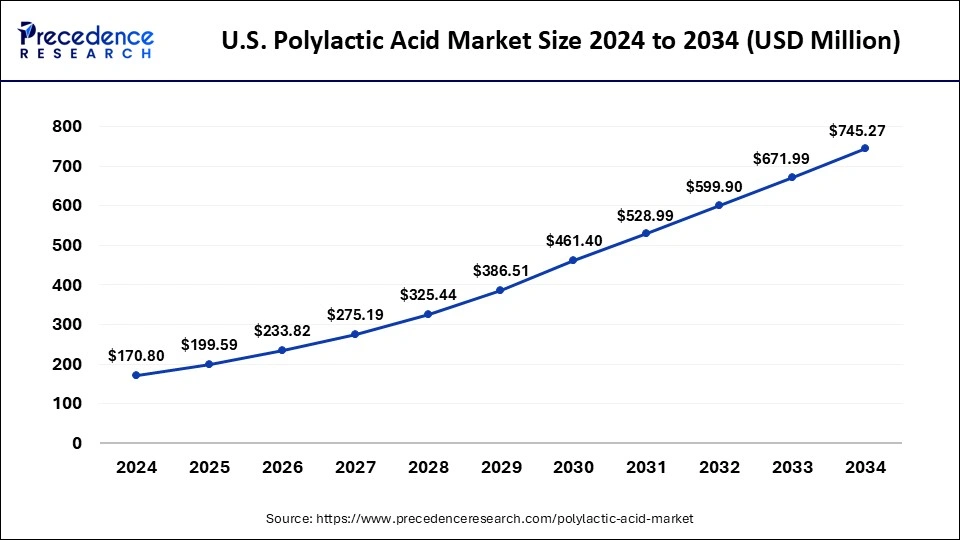

| U.S. Market Size in 2025 | USD 199.59 Million | |

| U.S. Market Size by 2034 | USD 745.27 Million | |

| U.S. Market CAGR (2025-2034) | 15.76% | |

| Base Year | 2024 | |

| Historic Data | 2020 to 2023 | |

| Forecast Period | 2025 to 2034 | |

| Segments Covered | Raw Material, Application and Regions | |

| Raw Materials Analyzed | Cornstarch, Sugarcane & Sugar Beet, Cassava, Others | |

| Dominant Raw Material (2024) | Cornstarch | |

| Top Applications | Packaging, Agriculture, Electronics, Textiles, Biomedical, Others | |

| Largest Application (2024) | Packaging (37.14% revenue share) | |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) | |

| Leading Region (2024) | North America (38.94% market share) | |

| Top-Contributing Country | United States | |

| Key Players | Nature Works LLC, Corbion Purac, Chongqing bofei biochemical products co., ltd. Synbra, Futerro, Nantong Jiuding Biological Engineering Co. Ltd, Hisun Biomaterials among others. | |

Set up a meeting at your convenience to get more insights instantly! https://www.precedenceresearch.com/schedule-meeting

Polylactic Acid Market Segmentation Analysis

Raw Material Analysis

How Corn Starch Segment Dominated the Polylactic Acid Market?

The corn starch segment dominated the polylactic acid market in 2024. The growing demand for cost-effective production of PLA increases the adoption of corn starch. The abundance of corn starch helps in the market growth. The well-established infrastructure for corn production increases the availability of raw materials for the production of PLA.

The strong government support for bio-based materials increases demand for corn starch for the production of polylactic acid. The increasing demand for renewable materials for the production of sustainable packaging materials fuels demand for corn starch. The growing demand for PLA derived from corn starch across various industries drives the market growth.

The sugarcane & sugar beet segment is growing at a significant rate in the market during the forecast period. The increasing awareness of plastic pollution increases demand for PLA derived from sugarcane or sugar beet. The availability of sugarcane and sugar beet in regions like India, Brazil, and Thailand helps in the market growth. The increasing focus on lowering the carbon footprint fuels demand for sugarcane and sugar beet. The growing cultivation of sugarcane and sugar beet supports the market growth.

Application Analysis

How Packaging Segment Held the largest Revenue Share of the Polylactic Acid?

The packaging segment held the largest revenue share in the polylactic acid market in 2024. The increasing demand for various packaging items like wraps, containers, and trays in the food and beverage industry increases demand for PLA. The rapid growth in e-commerce and the growing demand for sustainable packaging help the market growth.

The rising consumer preference for sustainable packaging increases demand for PLA. The focus on reducing plastic pollution increases the adoption of PLA in packaging. The increasing demand for microwavable containers is fueling the adoption of PLA. The rising adoption of eco-friendly practices in packaging fuels demand for PLA. The growing demand for various packaging solutions like containers, food trays, films, and bottles drives the market growth.

The textile segment is significantly growing in the market during the forecast period. The growing consumer demand for eco-friendly textiles increases demand for PLA. The increasing demand for home textiles and clothing helps in the market growth. The rising adoption of sustainable practices in the textile industry increases demand for PLA. The demand for suitable, smooth, and comfortable textiles increases the adoption of PLA fabrics. The increasing demand for non-woven fabrics and apparel supports the overall growth of the market.

Why did North America Dominate the Polylactic Acid Market?

North America dominated the polylactic acid market in 2024. The strong presence of industrial infrastructure and growing advancements in the PLA production help the market growth. The increasing environmental concerns and rising demand for sustainable products in various applications increase the demand for polylactic acid.

The strong government support for sustainable materials and focus on reducing plastic waste increases the adoption of PLA. The easily available raw materials, like corn, increase the production of PLA. The growing demand across sectors like textiles, electronics, packaging, medical devices, and automotive in the region drives the market growth.

How Big is the U.S. Polylactic Acid Market?

According to Precedence Research, the U.S. polylactic acid market size was valued at USD 170.80 million in 2024 and is expected to increase from USD 199.59 million in 2025 to USD 745.27 million by 2034. The U.S. market is registering a healthy CAGR of 15.76% from 2025 to 2034.

Polylactic Acid Trends in the United States:

- In Q4 2023, U.S. PLA prices were around US $3,345/MT in December, a notable decline from prior levels, due to softer demand and inventory buildup.

- In Q4 2023, U.S. PLA prices were around US $3,345/MT in December—a notable decline from prior levels, due to softer demand and inventory buildup.

- Accounting for the majority of U.S. PLA consumption and signaling heightened local investment and capacity growth (e.g. via companies like NatureWorks and TotalEnergies Corbion).

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

See what’s inside – Access the report sample today! https://www.precedenceresearch.com/sample/1244

Why is Asia Pacific Growing in the Polylactic Acid Market?

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The increasing consumption of packaged food and the rising demand for sustainable packaging fuel demand for polylactic acid. The supportive government policies for the use of eco-friendly materials increase the adoption of PLA, helping the overall growth of the market.

The well-established manufacturing sector in countries like South Korea, China, and Japan increases demand for PLA. The strong industrial base, including agriculture, electronics, and automotive, increases demand for PLA. The expansion of the packaging and textile industry drives the market growth.

Polylactic Acid Export Trade in Asia Pacific Countries

| Country Name | Export Year 2023 |

| China | $31.9M |

| India | $654K |

| Japan | $156 M |

| Thailand | $91.1M |

Related Topics You May Find Useful:

- The global bioresorbable polymers market size was estimated at USD 1.73 billion in 2024 and is predicted to increase from USD 1.97 billion in 2025 to approximately USD 6.17 billion by 2034, expanding at a CAGR of 13.56% from 2025 to 2034.

- The global ferulic acid market size is estimated at USD 77.89 million in 2024 and is anticipated to reach around USD 150.38 million by 2034, expanding at a CAGR of 6.80% from 2024 to 2034.

- The global sulfuric acid market size accounted for USD 15.56 billion in 2024 and is expected to be worth around USD 33.90 billion by 2034, at a CAGR of 8.1% from 2025 to 2034.

- The global phosphoric acid market size was estimated at USD 51.83 billion in 2024, and projected to hit around USD 54.21 billion by 2025, and is anticipated to reach around USD 81.26 billion by 2034, growing at a CAGR of 4.60% from 2025 to 2034.

- The global boric acid market size accounted for USD 779.17 million in 2024 and is predicted to reach around USD 1157.73 million by 2034, growing at a CAGR of 4.04% from 2025 to 2034.

Polylactic Acid Market Leading Companies

- NatureWorks LLC

- Corbion Purac

- Chongqing bofei biochemical products co., ltd.

- Synbra

- Futerro

- Nantong Jiuding Biological Engineering Co., Ltd

- Hisun Biomaterials

Polylactic Acid Market Strategic Insights:

- NatureWorks LLC continues to lead the PLA market with its Ingeo™ brand, backed by strong R&D and global distribution.

- TotalEnergies Corbion is expanding production in Asia and Europe, targeting packaging and textiles.

- Futerro focuses on fully integrated PLA production models, including lactic acid recovery.

- Balrampur Chini Mills is a new entrant tapping India’s sugarcane reserves for domestic PLA innovation.

Recent Developments:

- In April 2025, Praj Industries collaborated with Uhde Ltd to launch PLA technology. The technology focuses on the process from feedstock conversion to polymer production and produces a range of PLA. This PLA is available for industries like hygiene, packaging, and textiles. (Source: https://smestreet.in)

- In May 2025, Balrampur Chini Mills launched India’s first PLA brand in Kumbhi, Uttar Pradesh. The company is building an industrial-scale PLA plant with a per year capacity of 80000 tonnes. (Source: https://www.sustainableplastics.com)

- In December 2024, Acme Mills launched a biobased polylactic acid fabric line, Natura. The product focuses on addressing various environmental concerns, and the fabric reduces greenhouse gas emissions up to 75%. The product range includes needle felts, melt-blown textiles, spunbond nonwovens, and hydroentangled nonwovens. The material is applicable for various industries like packaging, furniture, filtration, food & beverage, automotive, and healthcare. (Source: https://worldbiomarketinsights.com)

Polylactic Acid (PLA) Market Segments Covered in the Report

By Raw Material

- Corn Starch

- Sugarcane & Sugar Beet

- Cassava

- Others

By Application

- Packaging

- Agriculture

- Transport

- Electronics

- Textiles

- Others

By Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

-

Latin America

- Brazil

- Mexico

- Argentina

-

Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

Future Outlook: What Lies Ahead for PLA

The PLA market is entering a phase of industrial scaling, especially in Asia-Pacific and North America. With a global focus on replacing petroleum-based plastics, increased R&D funding, and favorable government initiatives, PLA is poised to become a mainstream material across multiple sectors. The next decade will likely witness cost reduction breakthroughs and the expansion of end-of-life solutions for PLA-based products.

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com | +1 804 441 9344

This report is Readily Available for Immediate Delivery - Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1244

FAQs – Polylactic Acid (PLA) Market

1. What is Polylactic Acid (PLA)?

➢ Polylactic acid is a biodegradable, bio-based plastic made from renewable sources like corn starch, sugarcane, or cassava.

2. What is the PLA market size forecasted to reach by 2034?

➢ The market is projected to hit USD 3,864.79 million by 2034 from USD 1,121.69 million in 2025.

3. What’s driving the growth of the PLA market?

➢ Key drivers include rising demand for sustainable packaging, government bans on single-use plastics, and growing applications in textiles, medical, and automotive sectors.

4. What are the top applications of PLA?

➢ Major uses include food packaging, 3D printing, biomedical devices, textiles, agricultural films, cosmetic packaging, and electronics casings.

5. Why is PLA popular in the medical industry?

➢ PLA is used in drug delivery, implants, sutures, wound dressings, and tissue scaffolds due to its biodegradability and biocompatibility.

6. What are the main raw materials used in PLA production?

➢ Corn starch (dominant), sugarcane, sugar beet, cassava, and other biomass sources.

7. Which region dominated the PLA market in 2024?

➢ North America led with a 38.94% market share in 2024.

8. Which PLA segment held the highest revenue share by application?

➢ Packaging, with 37.14% of the market share in 2024.

9. What’s the CAGR of the PLA market from 2025 to 2034?

➢ The global market is growing at a CAGR of 14.73%; the U.S. market is growing at 15.76%.

10. What are the major challenges in the PLA market?

➢ High production costs, feedstock price volatility, limited composting infrastructure, and competition from other bioplastics like PHA and PBS.

11. How is technology shaping the future of PLA?

➢ Advances in polymerization, AI in process control, and enzymatic recycling are improving cost-efficiency and scalability.

12. Who are the top players in the PLA market?

➢ NatureWorks LLC, Corbion Purac, Futerro, Synbra, and Hisun Biomaterials.

13. What recent developments are shaping the PLA market?

- Balrampur Chini Mills launched India’s first PLA brand.

- Praj Industries partnered with Uhde Ltd for end-to-end PLA production.

- Acme Mills launched PLA-based eco-friendly fabrics.

14. Which country exported the most PLA in 2023?

➢ The United States led with USD 166 million in exports.

15. Why is Asia Pacific growing rapidly in this market?

➢ Due to rising demand for sustainable packaging, government support, and a robust manufacturing sector

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.